The debit to the Treasure Stock account reflects the new asset ABC Ltd holds in its own stock. And the credit reflects the company pays Kevin to buy his position out. We have now reached December, and the second and final call for class A shares is now coming due.

Issuing Common Stock with a Par Value in Exchange for Cash

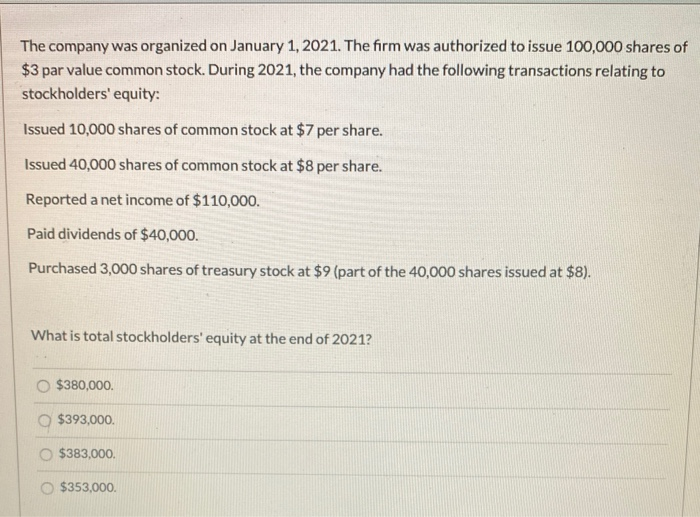

The share buyback will retain in the company for a future issues, employee compensation, or retirement. Par Value or Face Value or nominal value is the value state on the share or bond. Common Share par value is the legal value state in the company article of memorandum. Total stock par value is the amount that protects the corporate creditor in the case of liquidation. The shareholders are not allowed to withdraw the total capital from the company.

Issuing Preferred Stock

Corporations often set this figure so high that they never have to worry about reaching it. However, states do allow the authorization to be raised if necessary. For example, the company ABC issues 20,000 shares of common stock at par value for cash. Common shares represent an asset to the holder of the shares (the owner of the common shares) and are classified as equity on the corporation which issued the common shares. For example, on January 1, we hire an attorney to help in forming the corporation in which they charge us $8,000 for the service.

Journal Entries for Deferred Tax Assets and Liabilities

For that, it is crucial to separate the par value of shares from the total finance received. Overall, accounting for the issuance of a common stock involves the separation of the compensation received. As mentioned, this process includes calculating the par value of the underlying shares issued. Any excess amount received ends up on the share premium account. The journal entries for the issuance of common stock impact three accounts. The first involves the debit side, which usually includes the account to record the compensation.

Financial Accounting

This accounting treatment also differentiates this finance source on the balance sheet. Before understanding the accounting for the allotment of common stock, it is crucial to know what it is. The debit to the allotment account creates monies that are now due to ABC Ltd. The credit to the share capital account and the additional paid-in capital reflects where is money is coming from, i.e. from people investing equity into the company.

Issuance of Common Stock Journal Entry

In the above journal entries, the debit side involves the bank account. However, some companies may also issue shares in exchange for other instruments, for example, convertibles simple petty cash book format example or warrants. Similarly, some companies may offer stock to pay suppliers for their products or services. Nonetheless, the credit side will remain the same in most share issues.

Shareholders can only get access to those assets if the residual resources exceed the company’s liabilities. On top of that, preferred shareholders will get a preference during the distribution of the remaining assets. 3A few states allow companies to issue stock without a par value. In that situation, the entire amount received is entered in the common stock account.

The investors become owners of the company and are called stockholders. However, other sources of finance or equity do not have the same effect. On top of that, the accounting for the issuance of common stock differs from other sources.

There are two methods possible toaccount for treasury stock—the cost method, which is discussedhere, and the par value method, which is a more advanced accountingtopic. The company plans to issue most of the shares in exchange forcash, and other shares in exchange for kitchen equipment providedto the corporation by one of the new investors. Two common accountsin the equity section of the balance sheet are used when issuingstock—Common Stock and Additional Paid-in Capital from CommonStock. Common Stock consists of the par value of all shares ofcommon stock issued. Additional paid-in capitalfrom common stock consists of the excess of the proceeds receivedfrom the issuance of the stock over the stock’s par value.

- Likewise, investors typically do not deem that the par value of the common stock is necessary to exist before they purchase the stock for their investments.

- But if the stock market value is not available, we can use the asset’s fair value.

- Rather, the dividends on common stock are generally announced as a certain dollar amount per share, like $5 per share or $10 per share, etc.

- Common shares represent ownership in a company, and holders of common shares are entitled to a share of the company’s profits and assets.

You will hear the words “stock market” and “share market” used interchangeably. This journal entry will reduce the balance of the retained earnings by the different amount of market value and the par value of the common stock. And of course, the difference here is the result of the market value being lower than the par value, not the other way around. In general, the cost of the non-cash asset is either the fair value of the common stock given up or the fair value of the non-cash asset received. Of course, the fair value of the common stock is usually used if it is available since it is more reliable. For large stock dividends, retained earnings are debited only at the par value of the shares being issued.

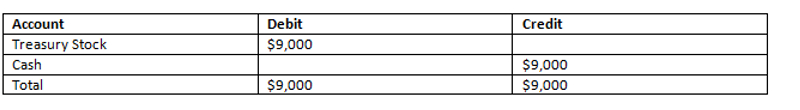

The company can make the journal entry for the issuance of common stock for cash at par value by debiting the cash account and crediting the common stock account. Thetransaction will require a debit to the Paid-in Capital fromTreasury Stock account to the extent of the balance. If there isno balance in the Additional Paid-in Capital from Treasury Stockaccount, the entire debit will reduce retained earnings. Notice on the partial balance sheet that the number of commonshares outstanding changes when treasury stock transactions occur.Initially, the company had 10,000 common shares issued andoutstanding.